For any employer seeking to pay their employees, knowing what a paystub is and how to create one for every pay period is necessary information to know. While federal law does not require employers to provide them, most states have laws that ask for some kind of written pay statement.

If you are wondering what is a paystub, read this guide to find out.

Table of Contents

What Is a Pay Stub?

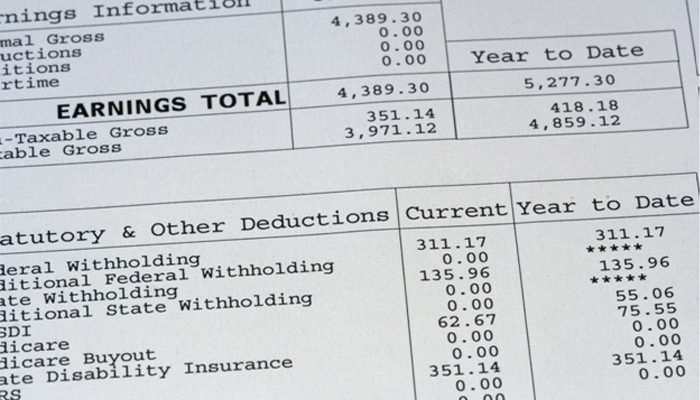

A pay stub is an item, usually attached to your paycheck, that outlines the details of a person’s pay during each pay period. On a physical paycheck, a pay stub is typically attached to the same piece of paper through the perforation. But, if employees get their checks digitally, they can access pay stubs via an online payroll system if your company uses one.

Below are some items that are usually listed on a pay stub.

- The employee’s name

- The pay period and date you are distributing the pay stub for

- Amount of hours worked during the pay period

- Gross pay

- Deductions, i.e. for 401(k)s, health, and medical insurance

- Federal and state taxes

- Any employer contributions

- The employee’s direct deposit information

- Net pay (amount of money going to the employee after taxes and deductions)

Having a pay stub lets employees know how much taxes you have deducted or withheld. It also provides a written record for employees to make sure they were paid in a certain period of time and as proof of income or employment.

How to Create a Pay Stub

You can create a pay stub through an amazing check stubs maker or through Excel or Google Sheets.

It is important for you as the employer to make sure there are no errors made when creating a pay stub. This is can affect your employees and business since it’s been estimated that 82 million Americans have had errors on their paycheck throughout their careers.

The Benefits of Pay Stubs

Outside filling an IRS requirement, there are benefits to creating pay stubs for your business. Taking the benefits into account will help your business in the long run and make your employees happy.

Some of the benefits include:

- being able to pay employees right aways when their pay period ends

- making sure any monetary information is accurate, especially when using a pay stub creator software

- being great data for any record-keeping purpose

- customizing the stub to add your company’s logo and any other important company information

- letting payday be manageable and without a lot of hassle since it can be created in just a few minutes

Pay stubs take away the stress of payday and let you take control of your patrolling process.

Understand the Pay Stub For Better Business

Pay stubs are important for a variety of reasons, including the ones we listed above. They are an essential aspect to making sure each employee gets paid properly and you do not have any discrepancies on payday. So the next time you wonder what is a pay stub, come back to this article for a refresher.

Pay stubs are just one financial aspect of running a business and it’s important to get it right, so check out our site for more fascinating business and finance articles.

You may also check: Installment Loan Vs Payday Loan: The Main